Annual Budget Planner - Berry Template

Annual Budget Planner - Berry Template

Couldn't load pickup availability

- 30-Day Guarantee: If you don’t save money, you get your money back - but trust us, you will!

- One-Time Payment: No hidden fees, no subscriptions - full AI access included for one year!

- Auto-Updated Every Year: Use the planner forever! Just renew your AI license yearly to keep smart features running.

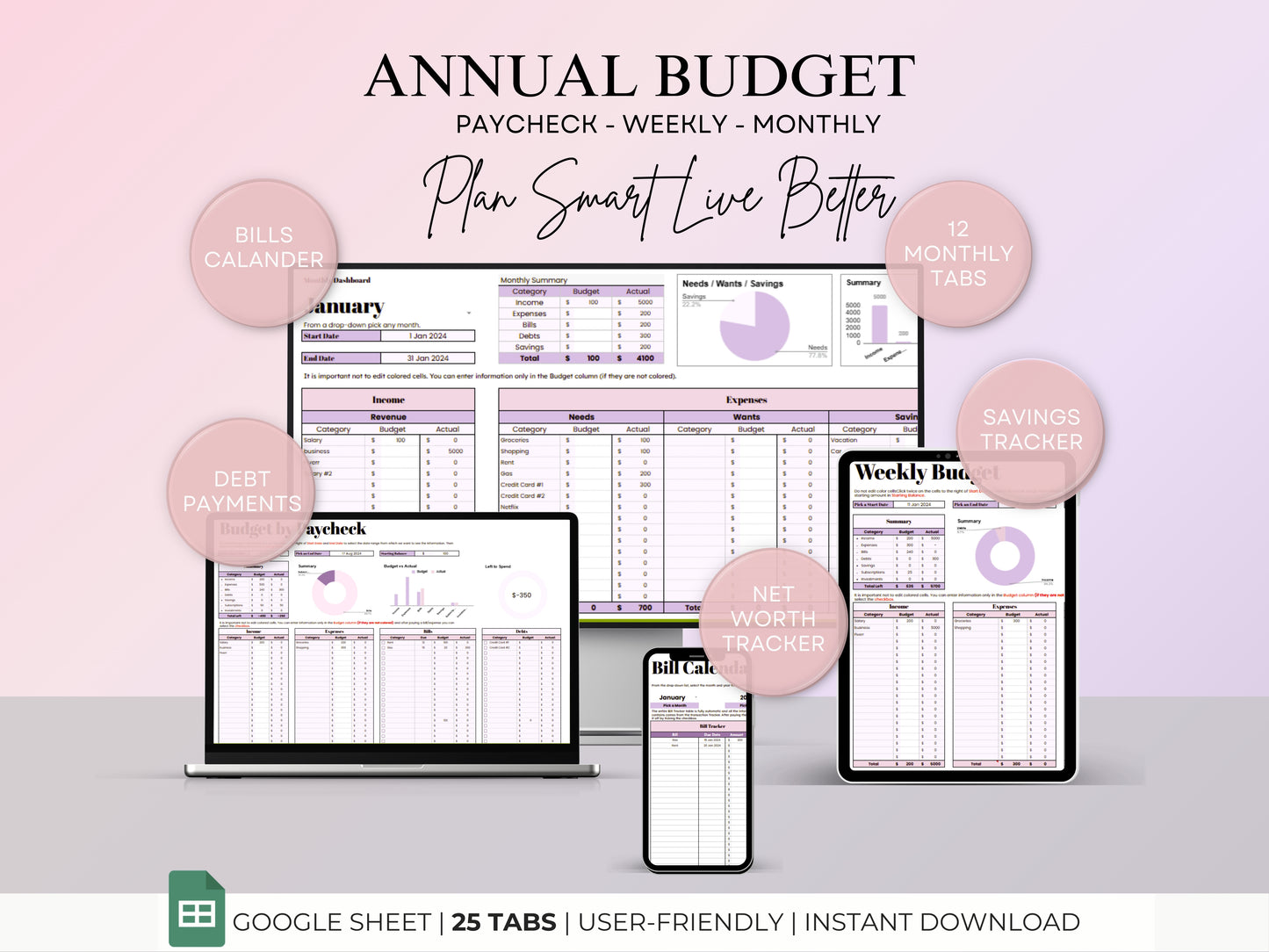

Finally, a Budget Spreadsheet Made for You

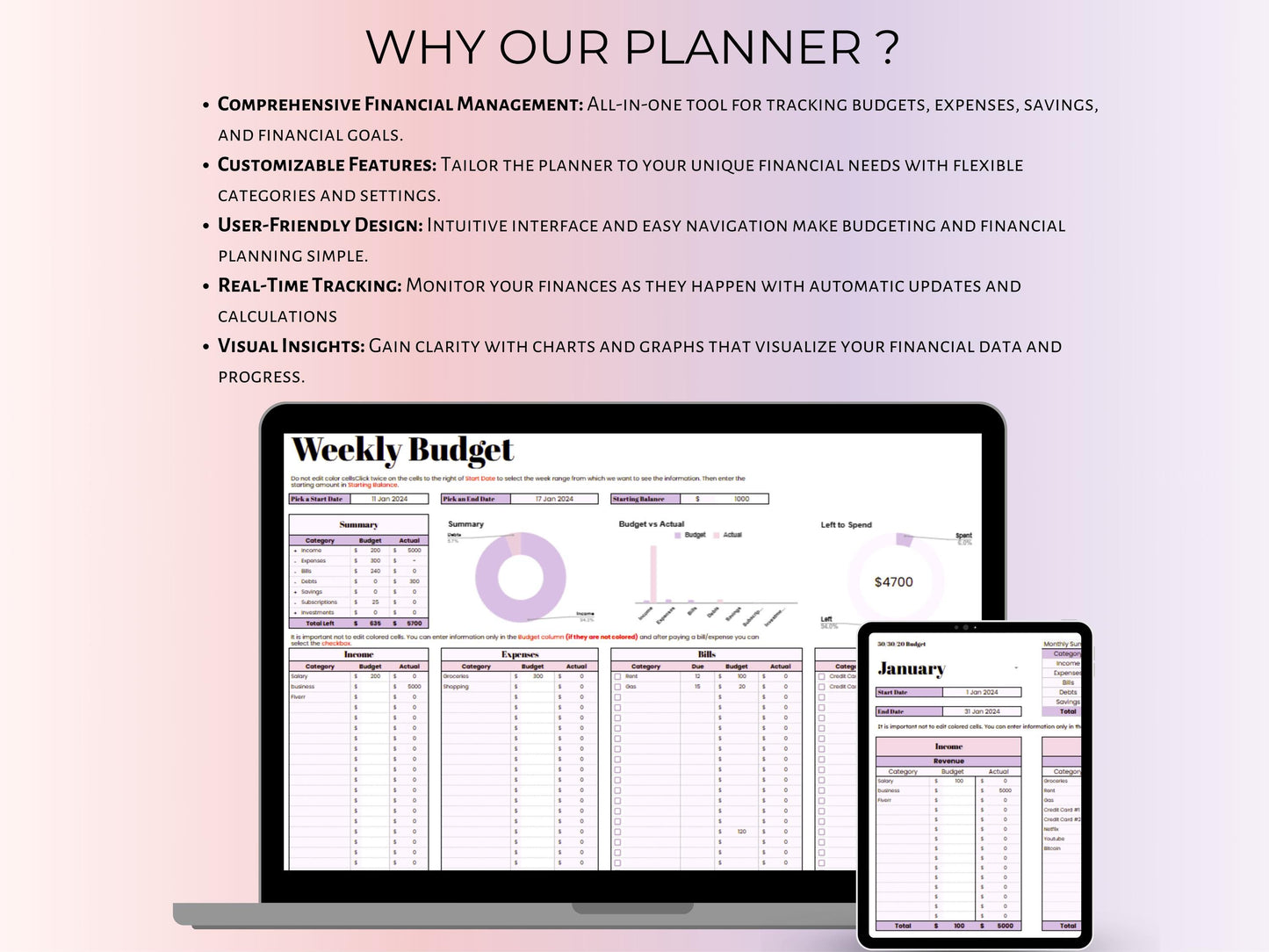

Are you tired of feeling like your money just disappears? Imagine having one simple tool that helps you stay organized, hit your savings goals, and take control of your finances—for good. This budget spreadsheet isn’t just helpful—it’s a game-changer for busy women like you.

Why You’ll Love It:

-

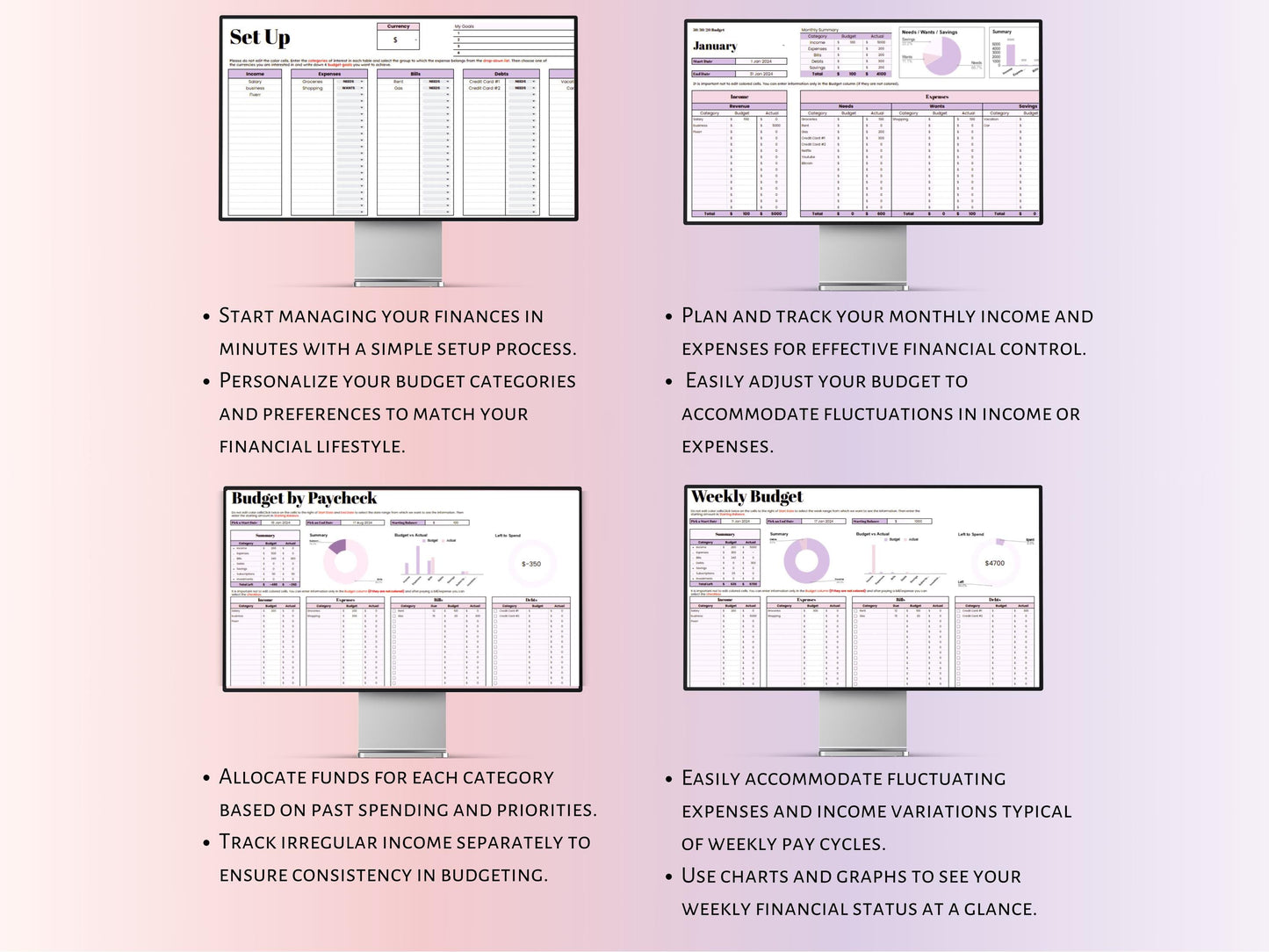

Organize Household Spending Your Way

Track your total household expenses or break them down by family member. Whether it’s groceries, bills, or fun extras, you’ll know exactly where your money goes without any guesswork. -

No More Missed Bills

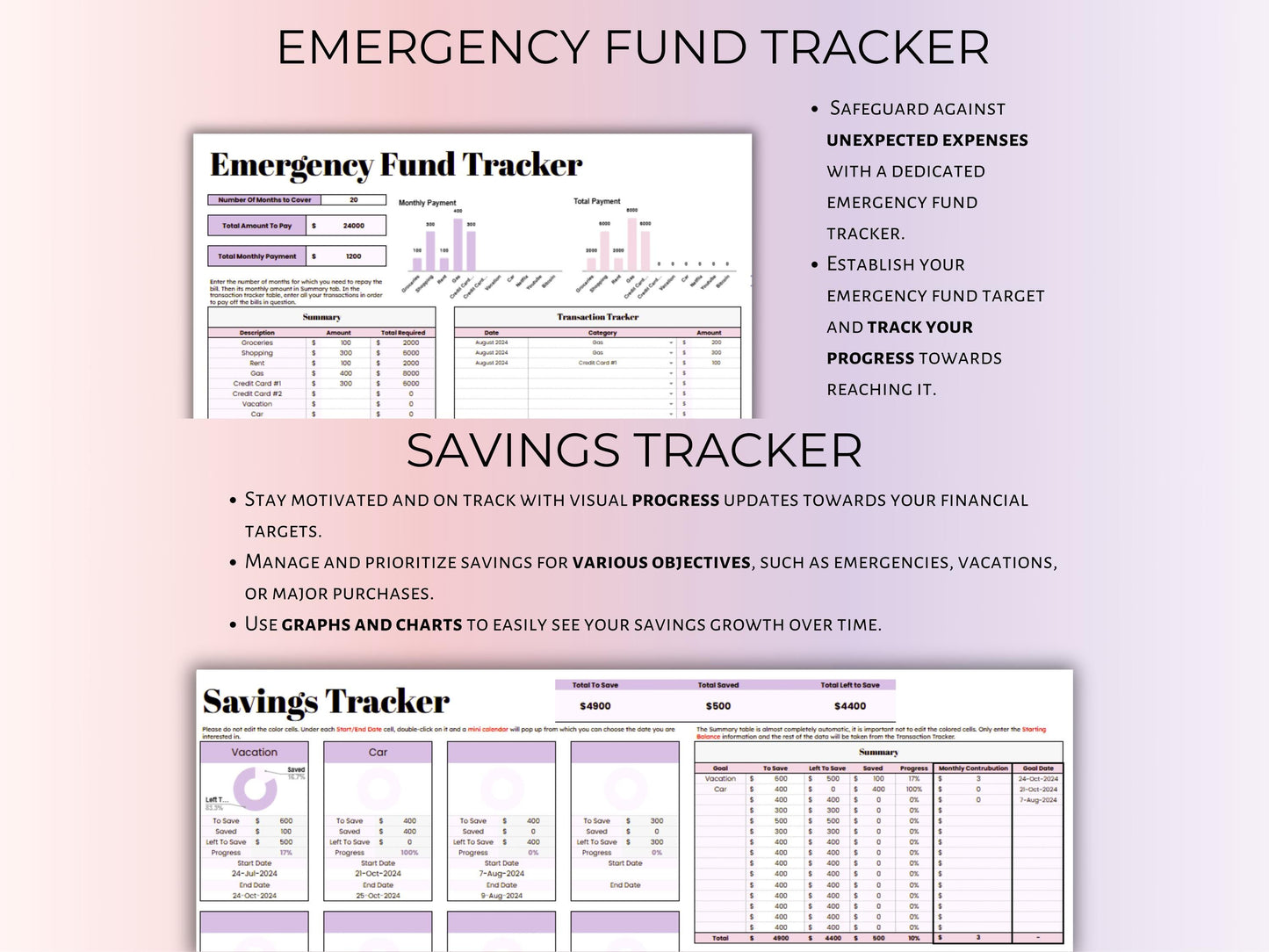

The Bill Calendar & Payment Tracker keeps all your due dates in one place and updates automatically. Say goodbye to stressful late fees and hello to financial peace of mind. -

Set and Crush Your Savings Goals

Whether it’s a vacation, an emergency fund, or that special treat you’ve been dreaming about, the Savings Tracker shows your progress every step of the way. -

Pay Off Debt Without Overwhelm

Track up to 28 debts, see how much you’ve paid, and watch your balances shrink. It’s like having a personal coach cheering you on to financial freedom. -

Plan Smarter, Not Harder

The Paycheck Budget Worksheet helps you stretch every dollar, so you’re not just covering bills—you’re making room for the things that matter most. -

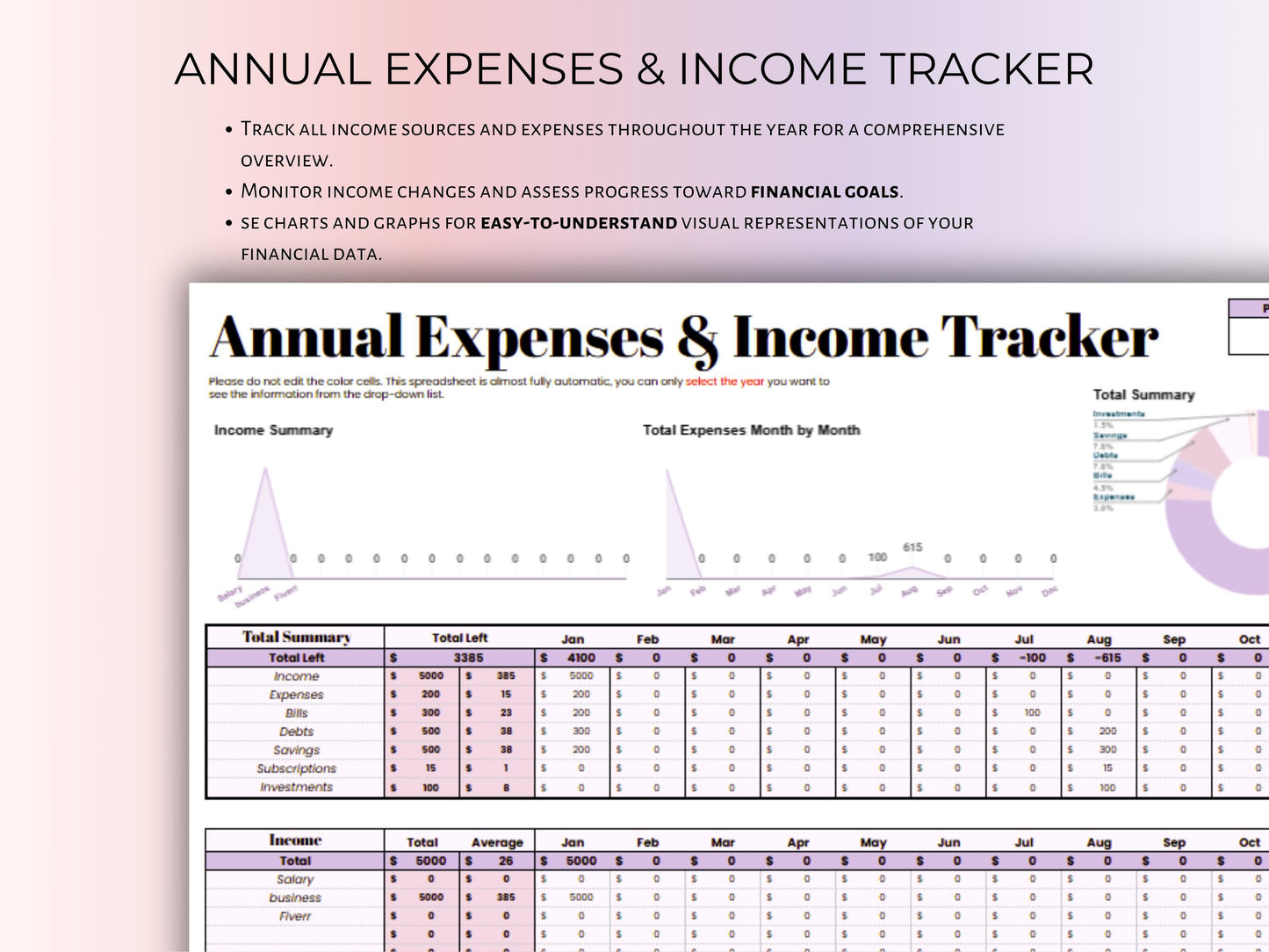

See the Big Picture

Compare your income and spending month-to-month with Yearly Comparison Tabs. Spot patterns, adjust your habits, and make smarter choices for your future. -

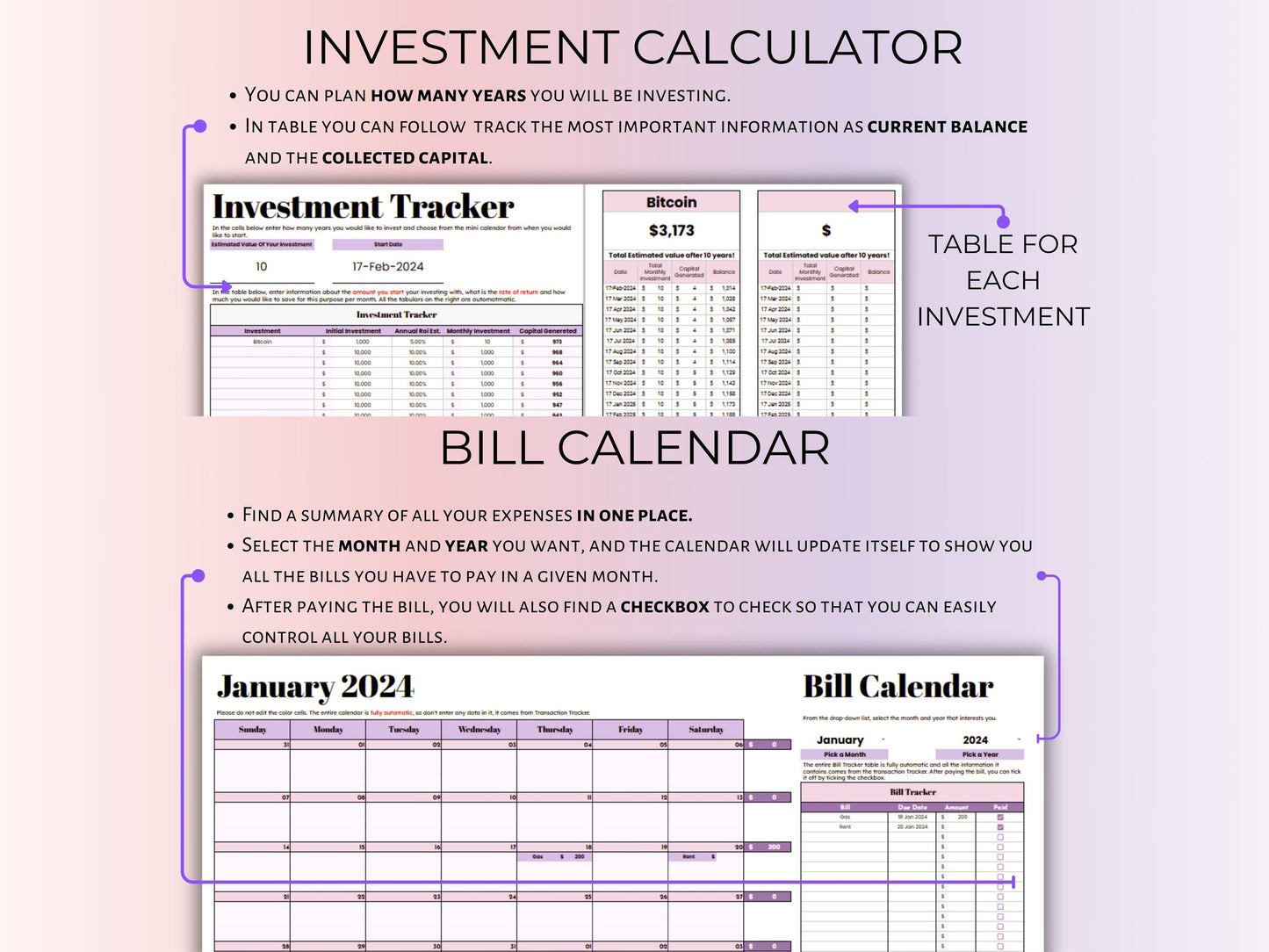

Know Where You Stand

The Net Worth and Investment Trackers give you a complete view of your financial health, so you can celebrate wins and stay motivated. -

Plan Ahead with Ease

Get 12 months of budgeting sections to map out your goals and keep everything running smoothly.

Why This Spreadsheet Stands Out:

- Made for Real Life: Whether you’re managing family expenses or focusing on your own goals, it adapts to your needs.

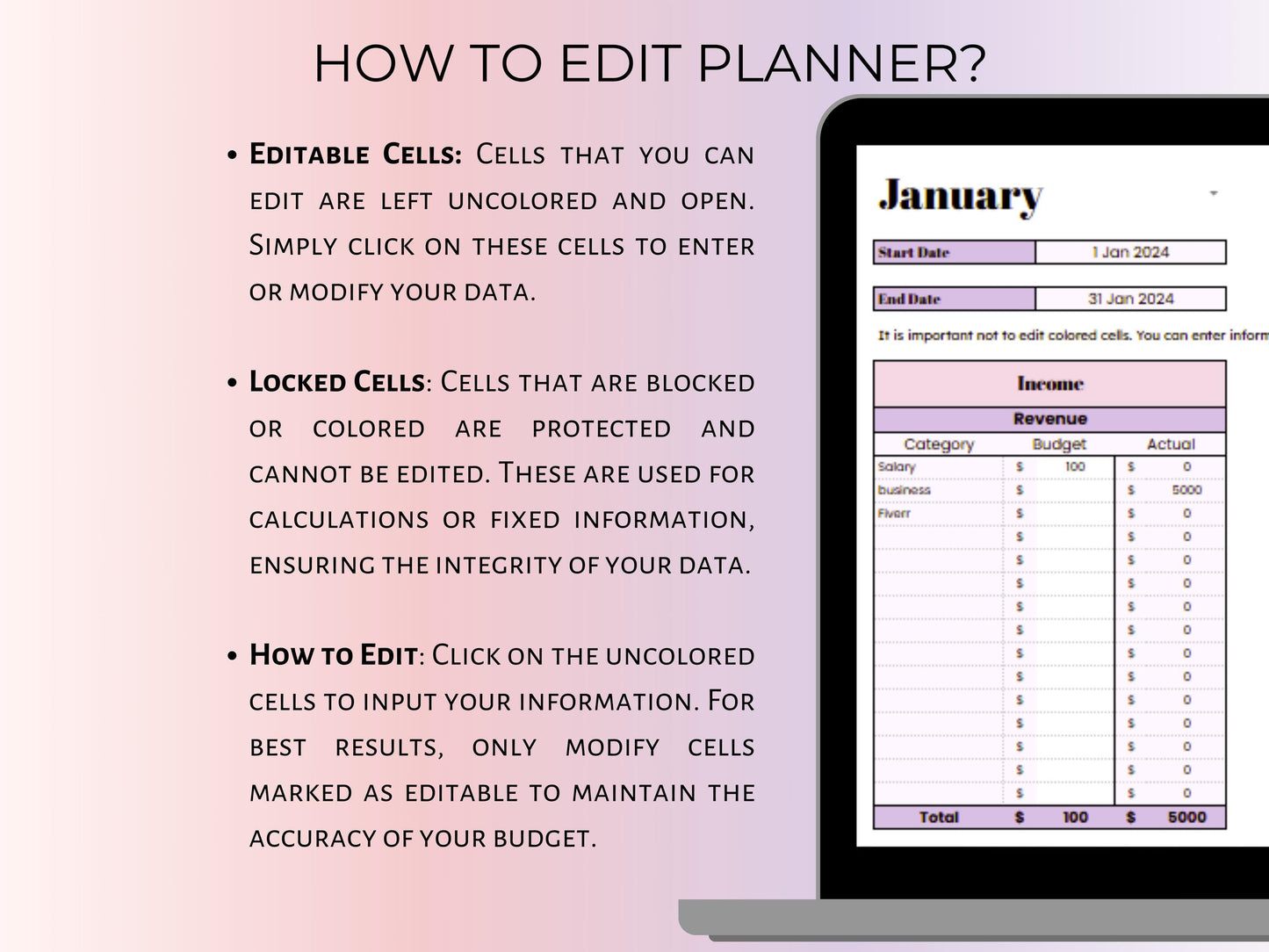

- Easy for Beginners: No tech skills? No problem. Step-by-step instructions make it simple.

- Accessible Anytime: Use it at home, at work, or on the go with Google Sheets.

- Designed for You: Clean, colorful, and stress-free—it’s a planner you’ll actually enjoy using.

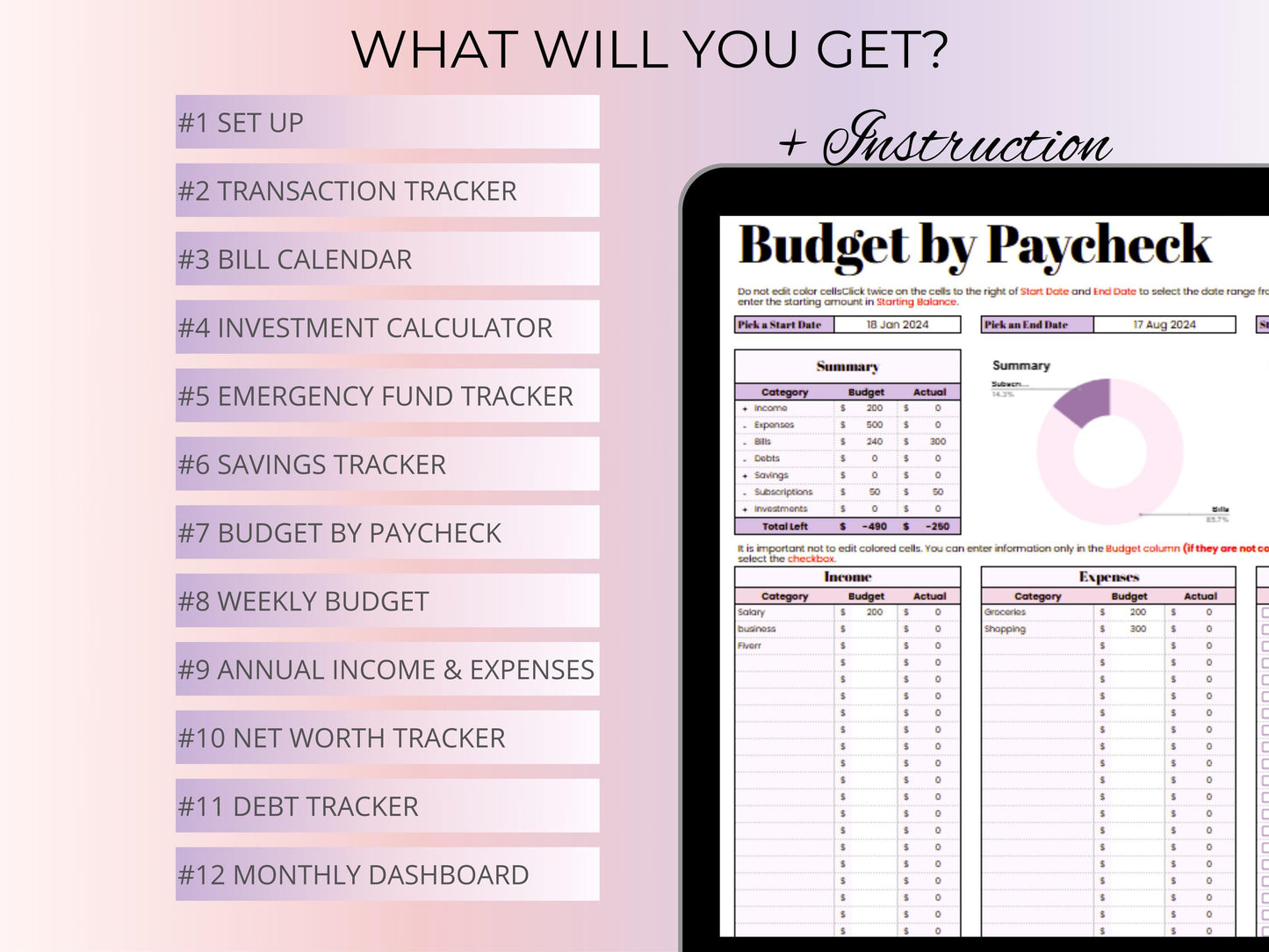

What You’ll Get:

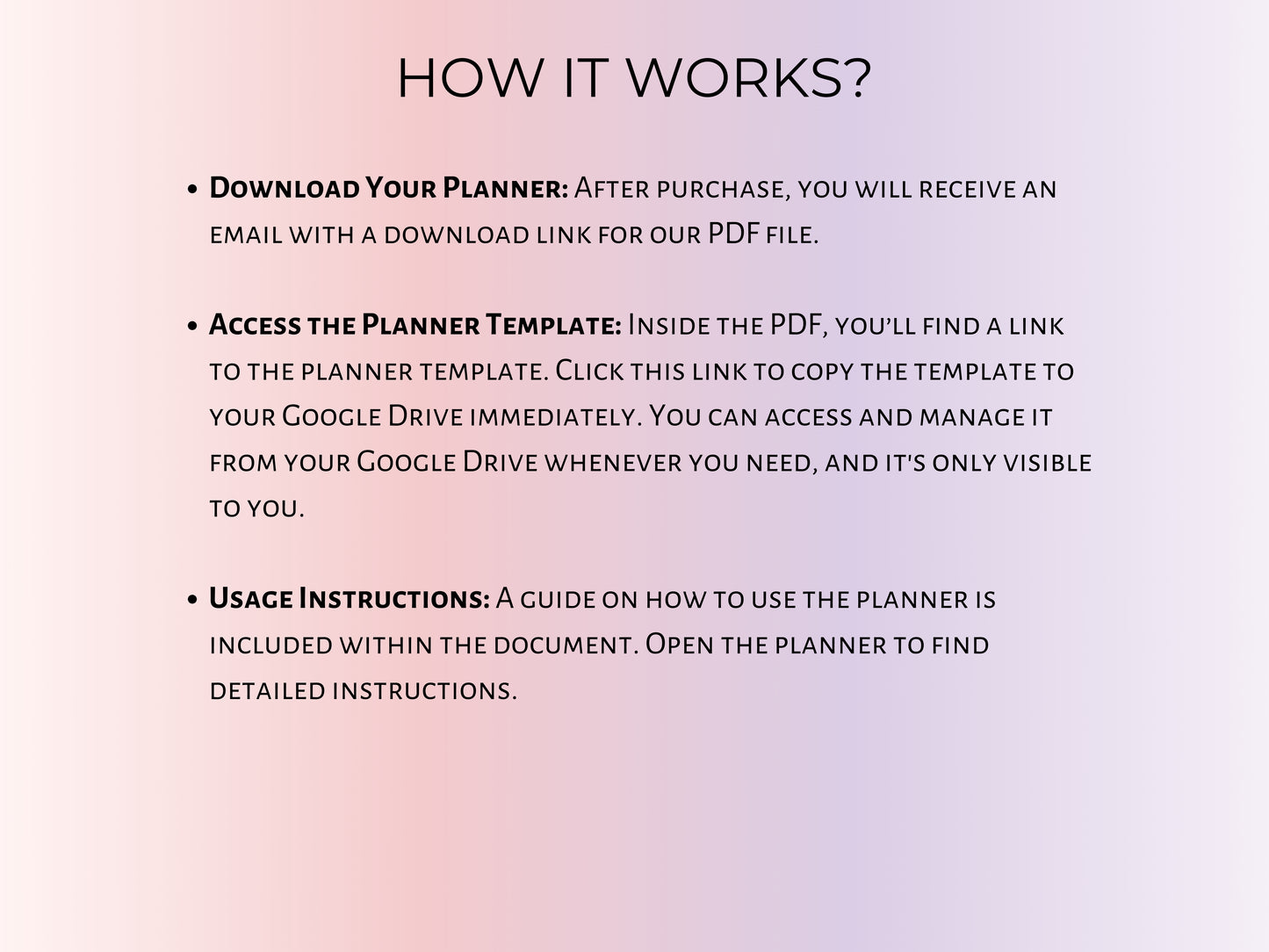

- Instant access to a PDF with a link to your spreadsheet.

- A tool that works for you, no matter how busy life gets.

You Deserve This

This isn’t just a budget planner—it’s a chance to feel in control, prepared, and empowered. Stop wondering where your money goes and start telling it where to go.

You’re not just buying a spreadsheet—you’re investing in your future. Isn’t it time to finally feel confident about your finances?

Share